IG, formerly known as IG Markets, has offered groundbreaking trading services since the 1970s, making it one of the most established and trusted online brokers globally.

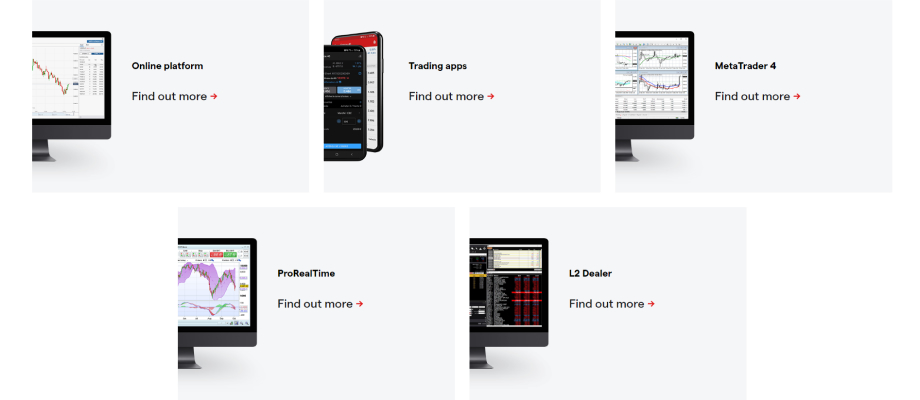

- A great selection of award-winning platforms for investment and trading

- 17,000+ assets offered on all the world’s most popular financial markets

- A fully licensed and trustworthy online broker in the UK and abroad

- High minimum contract sizes for many types of positions

- Sophisticated tools best suited for professional day traders

IG Markets is not only a world-leading provider of trading and online execution platforms, but it is also one of the most innovative companies in the industry, with a portfolio of unique and award-winning trading products.

The broker is a trusted destination and partner of choice for traders who want to succeed in today’s competitive trading environment. We’ve spent many hours researching this trading platform and studied all the details. The results of our work are below.

IG Markets is Best Suited For

Before taking a look at what IG is best suited for we want to clarify that this is an incredibly versatile broker that can be used for most types of trading and investments. But if we had to pick a few things that IG excels at, it would have to be the following.

Stocks is the number one thing that sets IG Markets apart from their competitors. And not the fact that they offer stocks since most online brokers do, but thanks to the fact that IG has more than 13,000 stocks on offer. That is, without a doubt, one of the largest selections available.

As with most online brokers, IG mainly provides market access in the form of CFDs. In addition, IG is a fantastic spread betting broker, and as a UK spread bettor, you don’t have to pay capital gain tax. So, if you want to keep all your profits, we suggest trying spread betting with IG.

Furthermore, IG is an advanced broker with sophisticated and complex features and tools. Due to this, IG is best suited for professionals or traders with some experience.

IG Markets – Who Are They?

IG Group was founded in 1974 in London, UK. This company is the management company of the online broker IG – formerly IG Markets – and is considered the very first spread betting broker in the UK. In addition to spread betting, IG is a forex and CFD broker through and through.

Today, the company shares are listed on the London Stock Exchange (LSE) and are part of the FTSE 250, meaning it’s one of the 250 biggest companies in the United Kingdom.

In other words, there is no doubt that IG is a leading online broker with a fantastic reputation internationally. The broker offers the ability to trade forex, CFDs, and spread betting through one of several trading platforms offered (including MT4 for forex).

IG Markets offers a wide range of financial instruments: currencies, commodities, stocks, indices, and cryptocurrencies, which are all easily available on one account. In fact, you can trade CFDs on over 17,000 financial instruments worldwide and across a range of different sectors. It allows traders to invest in different global markets and access all these financial instruments in one place.

When recommending brokers, we only considered safe and regulated operators, and IG has not just one but several trading licenses, including from the Financial Conduct Authority (FCA). IG Markets was also the first CFD provider ever to be licensed by the ASICs for the Australian market, further establishing the broker as a global corporation.

Read about the best FSCA regulated brokers and CFTC brokers in our other guides.

Compare IG Markets Features With Other Brokers

Compare brokers

Licenses and Security

To become a leading online broker on the global market, a broker has to receive licenses from each jurisdiction in which it wishes to operate. Naturally, since IG offers their services across the globe, the broker has been issued several brokerage licenses from the world’s toughest regulatory bodies. Below is a list of IG’s main licenses but keep in mind that UK traders only really have to care about the Financial Conduct Authority (FCA).

- UK – IG Markets Limited (IGM) and IG Index Limited (IGI) are two companies operated by IG Group and separately licensed by the FCA.

- EU – with licenses from the Cyprus Securities and Exchange Commission (CySEC) as well as the German Federal Financial Supervisory Authority (BaFin), IG can offer their services in all of the European Union (except for Belgium).

- Dubai – IG Limited is fully regulated by the Dubai Financial Services Authority (DFSA), giving the broker access to one of the hottest investment markets in the Middle East.

- South Africa – the broker is also regulated in South Africa with a broker license issued by the Financial Sector Conduct Authority (FSCA).

- Singapore – with a Capital Market Services license from the Monetary Authority of Singapore (MAS), IG can offer their trading platform in Southeast Asia.

- Australia & New Zealand – IG was one of the first online brokers to be allowed in Oceania thanks to licenses from both the Australian Securities and Investments Commission (ASIC) in Australia and the Financial Markets Authority (FMA) in New Zealand.

In addition, IG Group owns and operates the North American Derivatives Exchange (Nadex) on the North American market and they are also fully regulated to operate in Japan, which is quite unusual in the industry.

Assets Offered by IG

The single most impressive feature of IG Markets in the UK is the share number of assets provided with more than 17,000 on offer. These assets are traded either as CFDs or through spread betting which are very similar ways to trade, with minor differences. Most of these assets can be traded with leverage which increases the potential risks, so please be careful.

Here is a breakdown of the main markets for CFDs and spread betting that IG offers today, as well as a selection of other assets offered.

Lastly, IG provides a few unique services such as Out-of-Market trading and Weekend Trading. Out-of-Market trading gives you access to 70 US company shares during pre and post market times and you also get 24/7 access to major currencies and selected indices.

Weekend markets, on the other hand, give you 24/7 access to GBP/USD, EUR/USD, USD/JPY, several attractive international indices, and a range of other assets.

IG Fees, Commission, and Spread

IG is not a cheap broker by any stretch, but I can’t say it’s the most expensive either. Let’s call it well-balanced and competitive. Like most top online brokers, IG Markets offers free registration and no minimum deposit requirement, especially for bank transfers. Only card payments require users to deposit at least £50.

| Minimum Deposit | £0 |

This broker is commission-free but charges a spread on each position. With an IG account, you can invest in commission-free shares, trusts, and funds from a list of over 13,000 assets. The best part is that this broker now offers commission-free UK stocks in addition to the products that were available in the past. All shares now come with zero commission, but other fees, like a £15 same-day bank transfer charge for transactions less than £100, are applicable.

While trading and investing with IG, any uninvested cash of up to 100,000 GBP will earn 4.5% AER interest. Please note that the company increased its FX conversion fees from 0.5% to 0.7% in early April 2025. Additionally, other assets come with variable spreads and commissions. For instance, the spreads and commissions for forex pairs and share CFDs start from 0.6 points and 0.08% respectively.

In addition, IG requires accounts that have been inactive for 24+ months to pay an £18 monthly inactivity fee.

| Type | Fee |

|---|---|

| Opening an account | £0 |

| Overnight funding | depends on market |

| Withdrawal fee | £0 |

| Inactivity fee | £18 monthly after 24 consecutive months of inactivity |

| Advanced graphs (ProRealTime) | 1st month free, then £30 monthly |

Deposit Methods and Supported Currencies

As a UK trader, your account will automatically be set to GBP as base currency. This will help you avoid currency exchange fees and delays in deposits and withdrawals. If you live in another country, you may have to pay fees to deposit in your local currency unless you can make deposits in GBP, EUR or USD. Naturally, you can handle transactions using your desktop computer, laptop or smartphone.

In terms of payment options, you can choose from the following:

Note: In case you don’t live in the UK, there might be local methods available to you. You can see all the deposit methods available to you by logging in to your account and initiating a deposit.

Platform and Research Tools

One of the benefits to using an advanced online broker like IG Markets is that you can use industry leading tools to help you find value in markets, place trades, and manage risk. Since IG offers 17,000+ assets, there is also a range of platforms for different needs.

IG Markets – Smart Portfolios

Smart Portfolio is a trading service provided by IG Markets that gives you unique opportunities on thousands of markets. Using tailor made portfolios, created by professionals based on your needs and preferences, you can get exposure to a wide range of international markets.

This digital management service is award-winning and can easily be adapted to your comfort level regarding risk. That way, you never have to expose yourself to more risk than necessary.

The best part about these smart portfolios is the low price for them. The annual price of IG’s smart portfolios is 0.72% and the management fee is capped to £250 per year. What’s even better is that if you invest more than £50,000 in smart portfolios, IG will manage them for free.

In other words, using smart portfolios with IG market is an efficient and affordable way to invest for both beginners with limited budgets as well as professionals with bigger budgets.

As always, smart portfolios are not a guarantee that you will make profit and there are still risks involved. So please take the time needed to study how this type of investment works and how to optimize your efforts.

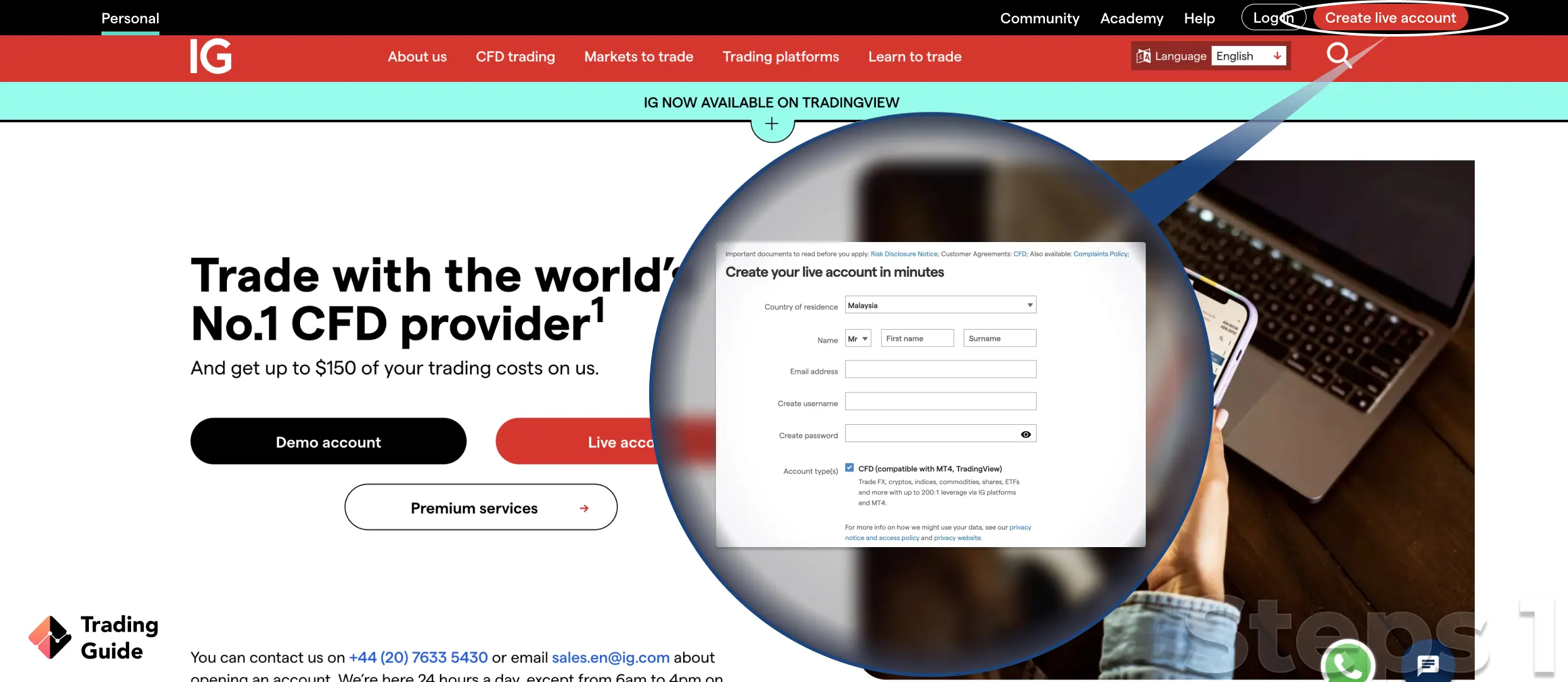

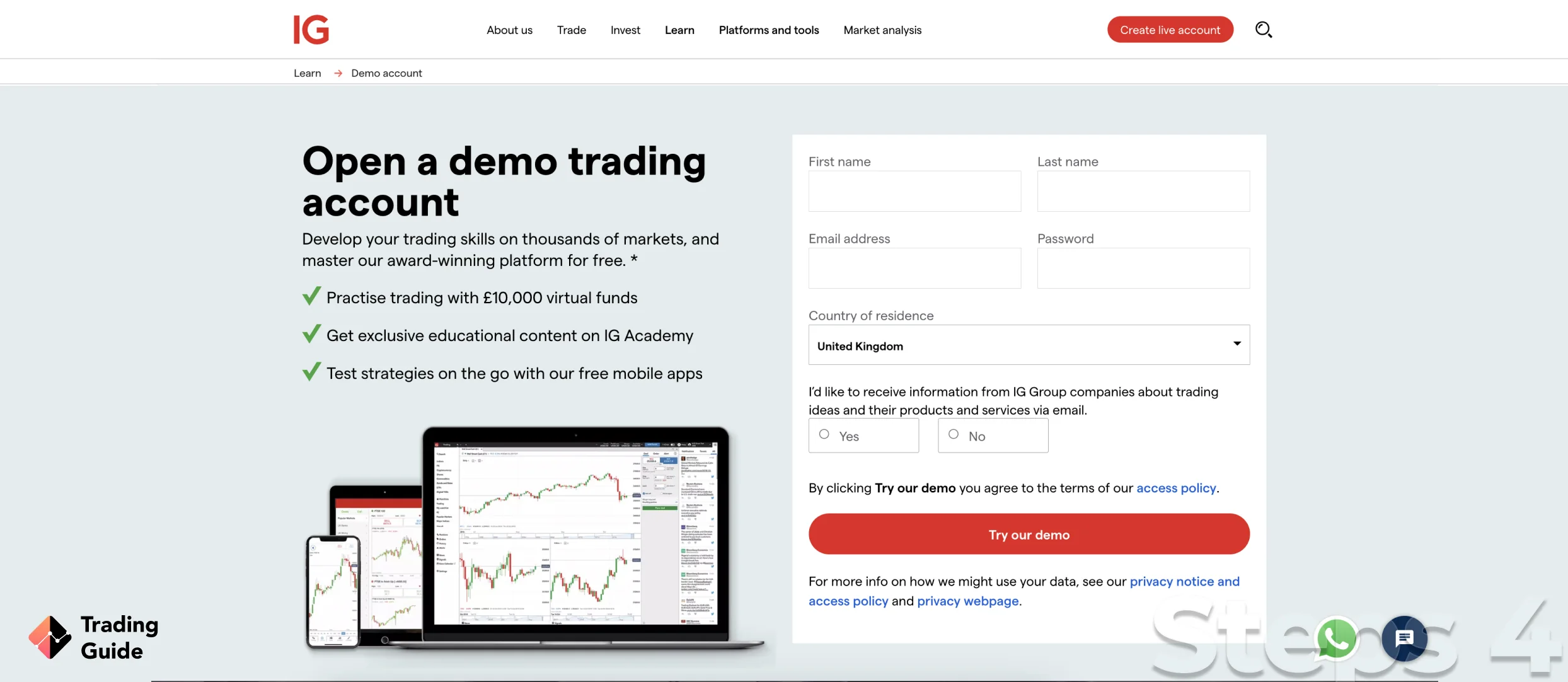

How to Register an IG Account

The UK financial market is strictly regulated by the FCA which, among other things, impose regulation regarding registration and verification. Because of this, IG uses the same universal registration process as all other online brokers on the UK market.

In case you’re not familiar with the process, we’ve outlined it for you here below.

Using the links provided on this page you’re directed to IG’s registration page. You’re allowed to register on any device you want to, be it an app, laptop or desktop.

All top-tier brokers, including IG, offer clear instructions on how to complete the registration. Similar to signing up for other online services, it requires you to submit personal details such as name, address, phone number, and certain financial details including your income.

Every FCA-regulated leverage broker will also provide a basic knowledge test to help determine your leverage levels. This is done to protect you from unnecessary risks and potentially detrimental losses.

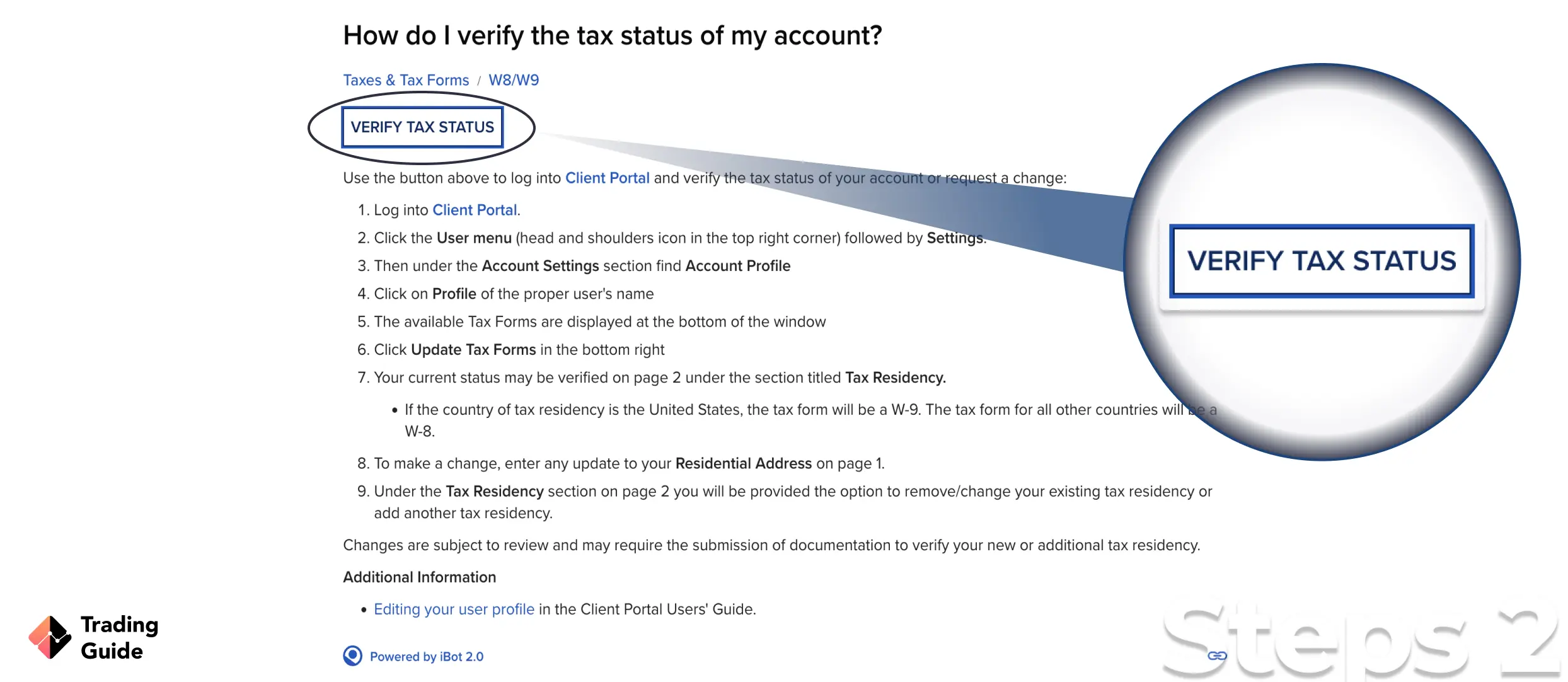

In accordance with UK financial regulation, you also have to verify your identity before you start using IG. To do this, you have to provide a copy of your national ID – passport, driver’s license, or official ID – as well as proof of residence – a recent utility bill or bank statement.

There is no way to avoid this step and you must provide accurate and verifiable personal details.

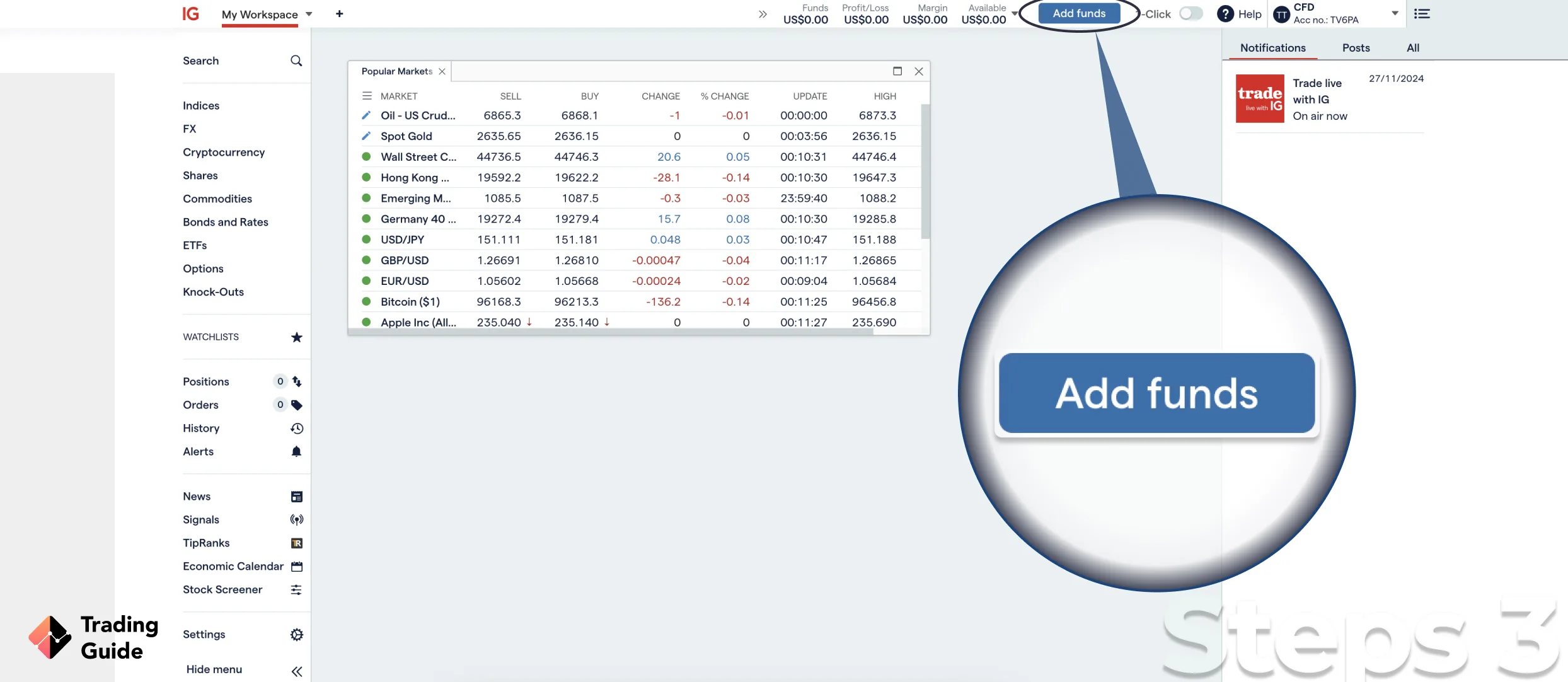

Once verified there is one last step to complete before you get full access to your account and that is an initial deposit. IG Markets has a minimum deposit level of staggering £250 which is among the higher in the industry.

You can deposit through credit and debit cards, PayPal, wire transfers, and a few other options.

With your identity verified and your first trading funds safely in your IG account, you can start trading forex or any other instruments that have caught your attention.

In case it is the first time that you’re using a trading app, we strongly advise that you spend some time studying trading before you get started. We also recommend opening a demo account that allows you to test the forex trading app and practice trading in a risk-free environment.

Editor’s Note

IG Group – the company that owns and operates IG Markets – is one of the leading financial companies in the UK at the moment. Despite being based in London, this UK broker is open to many other markets, including the rest of Europe, Australia, and countries in both Africa and Asia.

Today, IG offers over 17,000 markets and can boast the highest monthly turnover of any CFD broker in the world. The broker also has many years of experience in the financial sector and is known for its transparency.

Based on our extensive trading experience and over 200 hours of testing IG Markets, we are confident that this broker is 100% trustworthy. In fact, and without sounding biased, IG is the first hand choice for a lot of the members of our team, ie. we all trade using IG because it is just one of the best brokers available on the UK market.

FAQs

Yes, similar to most top online brokers, IG requires a minimum deposit to activate your account. This limit only has to be met the first time you make a deposit. After that, you can deposit as much as you want to and your deposit method supports.

IG currently has a minimum deposit of £250 which is among the higher in the industry. Then again, you also get access to some of the best tools and the best online broker in the UK, so it’s definitely worth it.

Unfortunately, this limit excludes budget traders from the platform. But luckily, there are plenty of brokers that have lower or no minimum deposit requirement at all.

Leverage is a tool used in trading to give you *leverage when trading. It’s used to increase your exposure to the markets with you having to put up more money. In other words, it is essentially a loan provided by your broker.

In the industry, you usually talk about leverage and margin, where leverage is the tool used and margin the amount put up by the broker. Today, in all of Europe and the UK, there are strict regulations on how much leverage a broker can offer. Major currency pairs have the highest leverage while risky stocks and other assets have the lowest.

A few years ago, there were no real leverage limits in Europe which caused financial catastrophes for many. That is why the use of leverage is tightly regulated today.

IG charges spread on every trade performed on their platform. Spread is a fee similar to commission that every online broker in the business charges.

Now, the spread varies from asset to asset and market to market. There can even be differences in spread from minute to minute. Therefore, we cannot say exactly how much a trade will cost you when using IG.

Luckily, the IG trading platforms clearly state exactly how much each of your trades will cost you. That way you can always keep track of your expenses and potentially profits.

IG offers access to more than 16,000 international stocks listed on the world’s leading stock exchanges. As a derivatives broker, IG mainly provides stocks as CFDs meaning you can trade any stock you want for any amount you want to. Unlike when investing, you have to pay the price listed on the exchange in question.

With that said, IG Markets is not a traditional stock broker where you invest in stocks and exchange-traded funds over many years. Instead, IG is best used for day and swing trading on the global stock markets.

This depends on the payment method that you’re using. Most withdrawals to a credit or debit card take between 2 and 5 business days to complete while wire transfers tend to take between 1 and 3 business days.

Withdrawing with PayPal is usually a faster option. Just keep in mind that you must withdraw your profits to the same payment method that was used for the last deposit you made. This is because of financial regulations.

There is no doubt whatsoever that your funds are safe with IG, or any of the other online brokers that we recommend on this site. Since the broker is licensed by the FCA, it has to follow certain rules about safety, encryption, and fund protection.

For example, any licensed broker has to keep the broker funds and customer funds separate. That way, your funds are safe no matter what happens to the broker. Not even in the case of a looming bankruptcy, can IG use your funds for anything.

IG can be a great option for beginners. However, generally speaking, IG is best suited for advanced traders with a large budget and some experience. This is only because IG is an advanced broker.

With that said, beginners can use IG and everyone looking for a great trading experience should consider it. Just be prepared to spend the time needed to learn the ins and outs of trading as well as all the tools and features provided by IG.

If you’re a beginner forex trader, IG is a perfect option because of MetaTrader 4 – the best forex trading platform in the world. MetaTrader 4 is really just as well-suited for beginners as it is for the most extreme forex day traders out there.

Most definitely! In fact, IG is developed and designed to be the ultimate day trading broker. With advanced tools, sophisticated features, and one of the largest selections of asset on the market, IG is a day traders dream broker.

Also, the fact that IG is one of the oldest and most established brokers in the UK, has resulted in a large number of professional traders using IG as their main broker and trading platform.

Yes, IG does charge overnight fees just like all other online brokers recommended by us. These fees are charged because the markets where the assets are listed close, it’s really as simple as that.

IG does have two unique services in the UK that allow you to avoid these fees and even make use of the after market hours. These services are Weekend Trading and Out-of-Market Trading. With these services you can trade a range of forex majors and other assets 24/7, ie. even after the markets are closed.

Most definitely! IG is one of the best brokers you will find on the UK market. The broker boasts many years of experience in the financial sector and is known for its transparency.

It is an easy-to-use platform and offers a wide range of financial assets including stocks, currencies, cryptocurrencies, commodities, and indices.

I had experience with IG and FXCM. Both brokers are among the top 5 and have solid business backgrounds. IG is stronger in the retail CFD market whereas FXCM is more competitive on the B2B side. This is the main difference between them as far as I reckon. I compared the retail customer bases of the two brokers and would go with the IG one since it has a higher internalization capacity hence better execution quality.

Is IG Markets an ECN broker?

IG does not offer ECN trading.

I have some reservations about this broker

I wanted to create a source of alternate earnings. All my colleagues were using various trading platforms for earning a decent amount. I did some research, read blogs, and watched videos to understand what trading was all about.

I made a ton of mistakes and learned a lot from them. Slowly I started earning profits. I devised strategies alongside. The customer support helps pretty quickly in answering queries as well.

I recommend it to everyone who is starting out. Do give it a try!

I am sharing some tips based on my experiences.

1. Just take every trade like a business transaction, the game becomes clearer and better. To bolster your odds of winning, get as much information as possible and make your own strategy with help of them rather than following herd mentality.

2. In the stock market, the reward is knowledge and strategy.

Some of my profitable trades only took a few hours or even some minutes. So focus on making every trade count so you’re not working the nine-to-five grind for the rest of your working life.

3. Learn from losses

So in the market, it is not like I’m winning 100 percent of the time or that I’ve never had losses.

4. Small gains add up over time

Just be like a conservative trader and take small gains as they come. By doing so, you can build your wealth strategically and without huge risk.

5. never feel uncomfortable in any trade or investment. If stock is not moving how you want or you are unsure about it, just get out from it.

6. Don’t worry if you miss out on any opportunity-you will get it next time.

7. You do not have to trade every day. When I was trading in the initial days, I trade every single day even if I am not sure about trade or place trade which have low profitability. This thing hampered my profits.

Now Whenever I am not feeling to trade or not finding suitable patterns which I crave for intraday trading, I decided to step away from the computer. I’ll get to trade tomorrow or maybe the next day. Let it play out.

I came to this broker because I noticed that it offered very beneficial trading conditions. The benefit is that with this broker it’s possible to save on each trade and it’s true for both long-term trading and scalping. If you are a scalper you will benefit from tight spreads and appreciate the absence of commission. You know that commission can be especially biting when you face an unhappy day in scalping and therefore commission bites off a great deal of your already miserable daily gain. Of course, it’s a very disappointing thing, although it stimulates to scalp better. Nevertheless, any scalper would choose trading without commission and IG gives such an opportunity. If you are a long-term trader, you will undoubtedly appreciate swap-free trading. Swaps can also be irritating especially when a pullback lasts longer than expected. I combine scalping and long-term trading and this broker fits me. However, when I started to trade here I had to get used to its $50 withdrawable amount. Earlier I was used to withdraw small amounts nearly every day. However, I can’t regard it as a big downside. You should realize that it’s the price for good trading conditions.

For me its universal trading platform that will be flexible for all traders. It's suitable for anyone to trade here with swap free account. With just £250 minimum deposit, you can start to trade quickly on basic market instruments like forex, metals, indices, and energies. By using the Metatrader4 platform, you can use extra options like multi terminal or multi account manager for better trades. Its very simple in use and user friendly.

The IG trading platform offers a lot of information that is updated in real time. The only point is that payment by card is one-way. If, for example, you deposited $1,000 to a debit card, you can withdraw $1,000 back to that card, no matter how much you earn from the trades. If you want to cash out the money you've earned, they require scans of your ID and bank information. I have doubled my initial deposit by 2x and cannot withdraw my earnings until I email my personal details.

IG markets is the ideal broker. I started with this platform very recently, but I already feel the benefits of using them. I regularly pick up money from IG markets once a month without problems. Excellent service, very polite staff.

Happy to be trading with IG Markets. Very good customer service. I have referred many friends and they also feel the same. I think it is a great opportunity to earn money this way.

Everything works ok. When i have a problem, they helped me by chat. So... nice!

Easy to use, and plenty functions that are easily accessible to use.

I am a beginner in the world of trading, and making a trading account was as far away from me as ever. Thanks to customer service for helping with it. IG platform is also very flexible and full of automated features. Fast withdrawal - it is also an advantage when you choose the broker.

Very impressed with IG! I set up a live CFD forex account and was fully up and running within a few hours. The broker is great and I would recommend it to my friends.

I found this broker 2 months ago and I am totally content. The customer service is 10/10. So simple to use. The mobile app is very fast and responsive.

The customer service is polite and very professional. IG markets are really good. But sometimes fees were confusing.

Would you recommend this provider?

Fees

Account opening

Customer service

Deposit and withdrawal

Would you recommend this provider?

Fees

Account opening

Customer service

Deposit and withdrawal